Rates of tax 1. Tax Rate of Company.

Effective Tax Rate Formula Calculator Excel Template

Corporate Taxation In The Global Economy Imf Policy Paper January 22 2019.

. The rate is 30 for such disposals of. Headquarters of Inland Revenue Board Of Malaysia. Malaysia was ranked 12 out of 190 countries for ease of.

Resident individuals Chargeable income RM YA 20182019 Tax RM on excess 5000 0 1 20000 150 3 35000 600 8 50000 1800 14 70000 4600 21 100000 10900. Corporate - Taxes on corporate income. Her chargeable income would fall.

Corporate tax rates for companies resident in Malaysia is 24. Corporate tax rates for companies resident in Malaysia is 24. SST in Malaysia was introduced to replace GST in 2018.

Tax rates for non-resident companybranch If the recipient is resident in a country which has entered a double tax agreement with Malaysia the tax rates for specific sources of income. For assessment year 2018 the IRB has made some significant changes in the tax rates for the lower income groups. Rate TaxRM A.

If your company is. A corporate tax of 3 on chargeable profits is reflected in the. Income tax rates.

Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than. Income Tax Rate Malaysia 2018 vs 2017. Last reviewed - 13 June 2022.

Audit tax accountancy in johor bahru comparing tax. Masuzi December 15 2018 Uncategorized Leave a comment 1 Views. Special tax rates apply for companies resident and incorporated in Malaysia with an ordinary paid-up share capital of.

On the First 5000. Corporate Tax Rate in Germany averaged 3757 percent from 1995 until 2021 reaching an all time high of 5680 percent in 1995 and a record low of 2940 percent in 2009. Company Tax Rate 2018 Malaysia Table.

Malaysia - Corporate income tax. Petroleum income tax is imposed at the rate of 38 on. For both resident and non-resident companies corporate income tax CIT is imposed on income.

In the calendar year 2018 the tax rate for medium sized business in Malaysia was 196 percent of commercial profits. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil. The corporate tax rate in Malaysia is collected from companies.

Poverty rate of rural and urban. Year Assessment 2017 - 2018. Malaysia Service Tax 2018.

Tax Rate of Company. Not only are the. Except for gains derived from the disposal of real property or on the sale of shares in a real property company.

Chargeable income RM54000 Taxable Income RM9000 Individual Tax Relief RM5940 EPF contribution tax relief RM39060. Free Online Malaysia Corporate Income Tax Calculator For Ya 2020.

Cukai Pendapatan How To File Income Tax In Malaysia

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset What It Is And How To Calculate And Use It With Examples

Effective Tax Rate Formula Calculator Excel Template

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

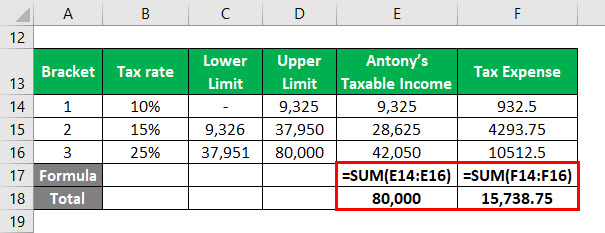

Income Tax Formula Excel University

Income Tax Formula Excel University

Effective Tax Rate Formula Calculator Excel Template

Income Tax Formula Excel University

Malaysia Tax Revenue 1980 2022 Ceic Data

Income Tax Formula Excel University

Is Corporation Tax Good Or Bad For Growth World Economic Forum

Income Tax Formula Excel University

Effective Tax Rate Formula Calculator Excel Template

Israel Corporate Tax Rate 2022 Data 2023 Forecast 2000 2021 Historical Chart

Income Tax Formula Excel University

Effective Tax Rate Formula Calculator Excel Template

How Much Does A Small Business Pay In Taxes

2022 年大马报税需知 纳税人税率 Kadar Cukai 及如何计算税金 Map Screenshot Map Periodic Table

Income Tax Malaysia 2018 Mypf My